2-ETF Strategy Protects Capital During Every Market Crash

Crash-Proof Your Portfolio in 10 Minutes with This 2-ETF System

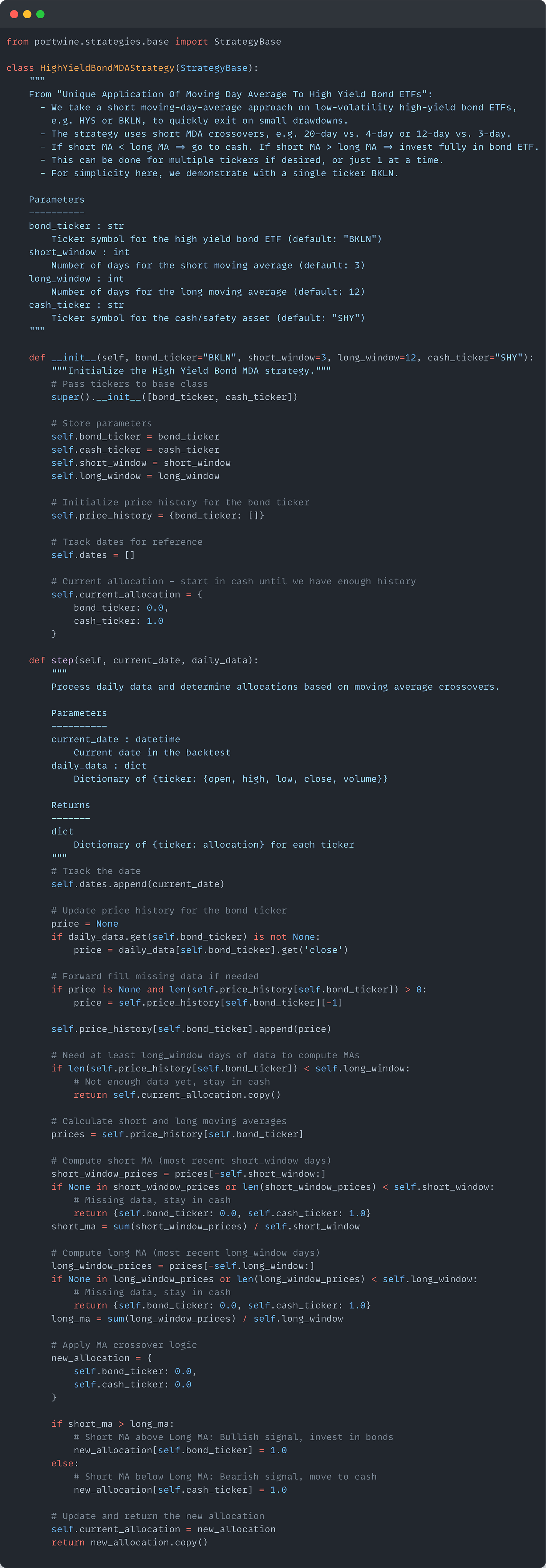

I dug back into the SeekingAlpha bank and found a post by an author named Cliff Smith titled Unique Application Of Moving Day Average To High Yield Bond ETFs that dives into the strange effectiveness of moving average crosses on bond ETFs.

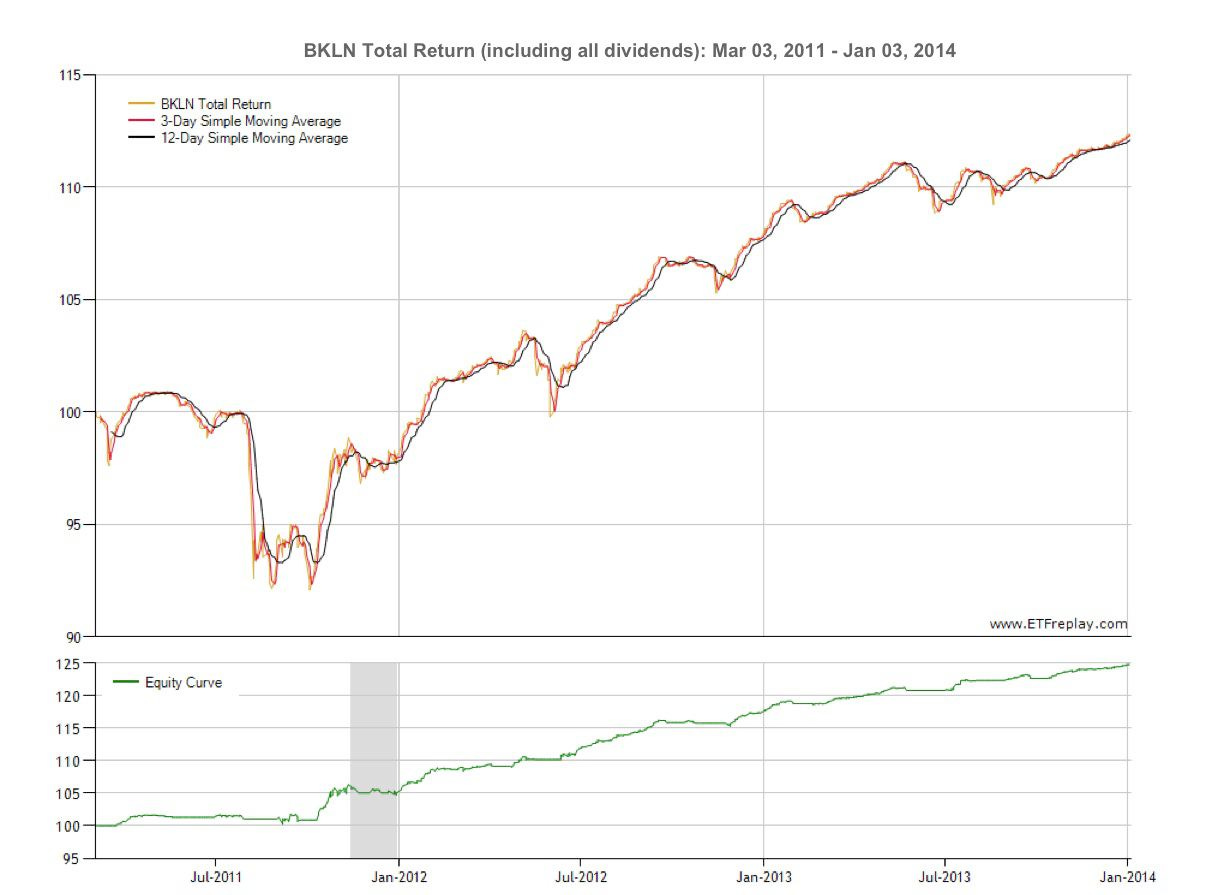

Cliff discusses how a simple long-short window moving average cross can capture a lot of the alpha in certain bond ETFs like the one above. This chart shows BKLN with a 12-day and 3-day moving average and the equity curve is buying when the 3-day outperforms the 12-day (crosses above).

Thus the strategy is very simple:

Buy BKLN when the 3-day moving average is above the 12-day moving average.

Buy SHY otherwise.

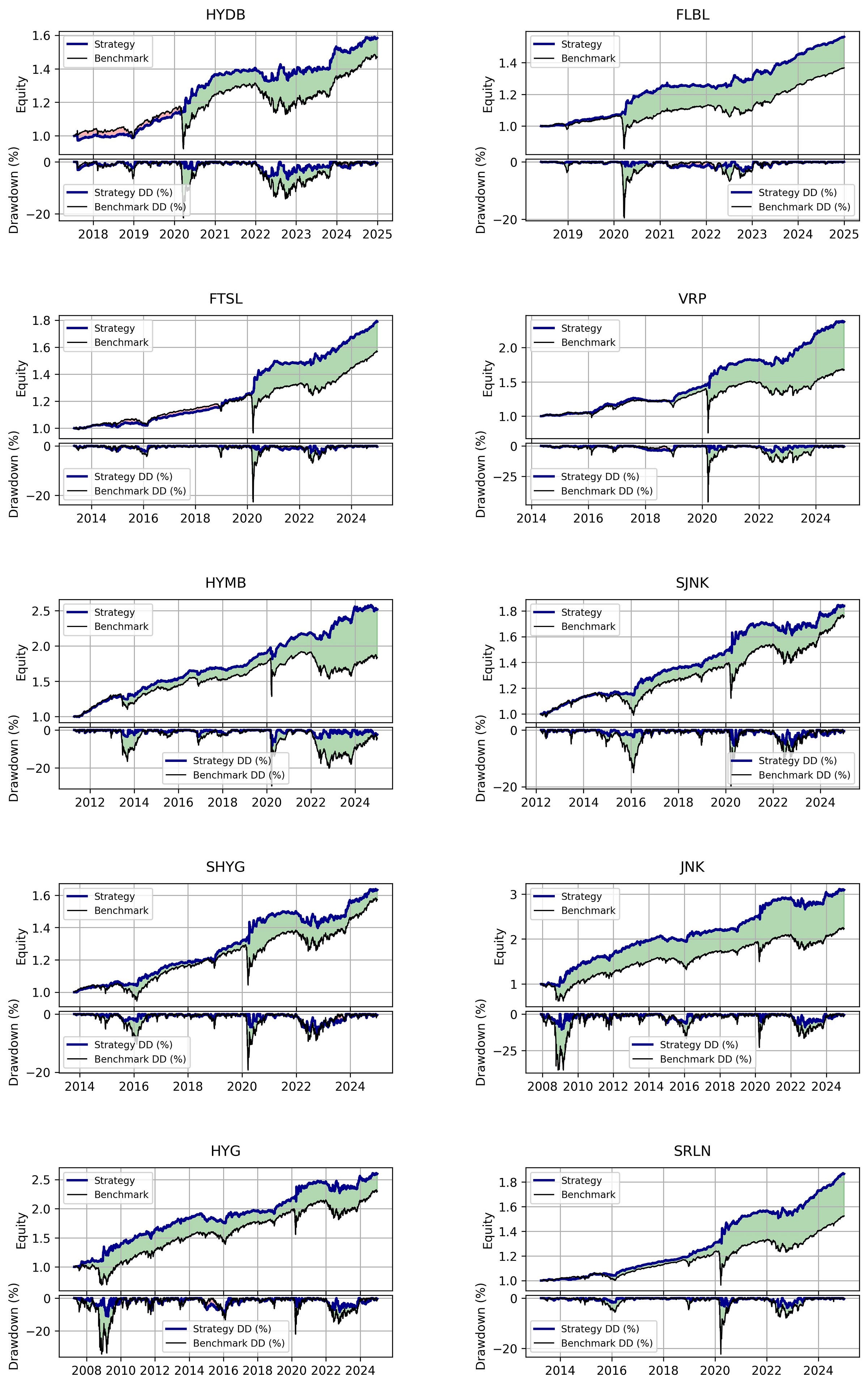

It sounds ridiculous because the moving average cross is the first trading system we learn about as quants. Does it really have alpha? But, the data was promising so I coded up a strategy for portwine (posted at the end of the article) and I ran the test on 12 other bond ETFs to see if it held up. Here is what I got:

In every example I used, the strategy outperformed the benchmark which is the asset itself in this case (moving average strategy of HYG vs buy and hold HYG).

But the most interesting part is that it seems to completely hedge against all the major market crashes. These tickers weren’t active for the 2000 Dot Com Crash, but for 2008, the 2016 slump, and 2020, they all evade drawdowns while providing optimal returns.

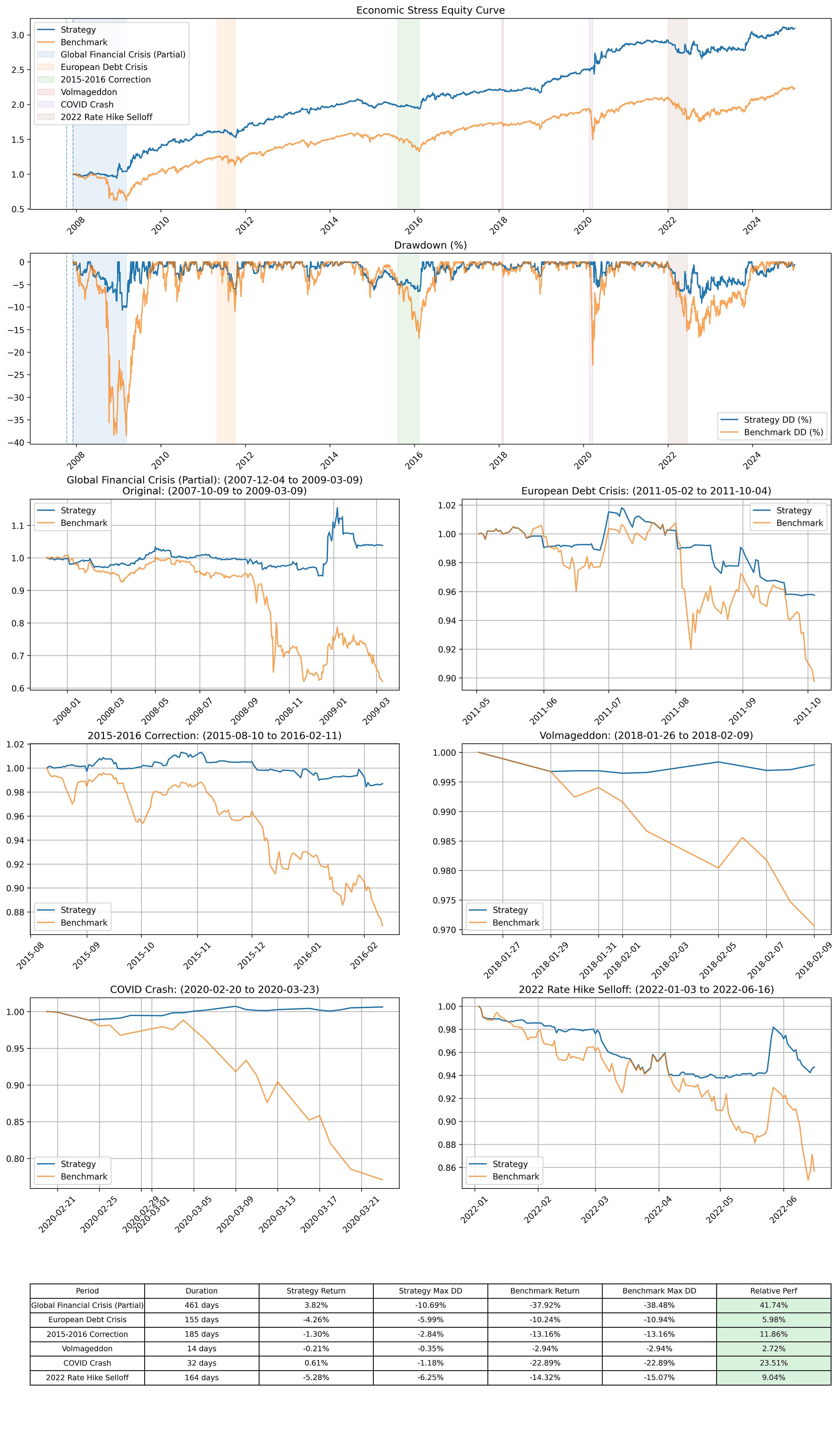

I took JNK, as it had the most history and ran a shock test on it:

In every period, the switching strategy outperformed buy and hold of JNK. It hedged amazingly against every market downturn. The most surprising aspect is that it actually made money during the 2008 Global Financial Crisis. This is big.

Beating the Market with Bonds

This strategy provides greater returns than buy-and-hold with a fraction of the risk and drawdown, and hedges again all market downturns. It’s simple, uses only a moving average crossover and two highly liquid ETFs. Now let’s leverage it to beat the market.

I apply a 2x leverage to the strategy returns. Getting 2x leverage from any retail broker is simple, so this is a basic assumption. Here are the results:

The JNK-SHY 2x strategy outperforms every benchmark and by a wide margin. The volatility is down by over 30%, and the drawdown is completely obliterated.

Again, with these simple rules:

Buy JNK when the 3-day moving average is above the 12-day moving average.

When it’s below, liquidate JNK and buy SHY.

Easy.

There’s insane amounts of alpha out there in extremely simple and understandable strategies. Don’t let thoughts of hedge funds and high-frequency trading scare you. Pick up a pen and paper, jot down your ideas, get testing. Or, just take this strategy as a starting point and build upon it.

There’s more than enough money to go around for everybody.

Hi, very insightful. Thanks for the post. My first question would be whether this backtest account for the trading costs and bid-ask spreads. Given the short-times MA I imagine there would be quite a bit of trading around the positions.

Thanks!

Thanks for writing these! They are very helpful.

How do you fit strategies like this into a single portfolio?